In pursuing financial stability, many overlook the potency of minor lifestyle tweaks that, when aggregated, can significantly cushion our wallets.

This compilation of 20 little adjustments ventures beyond the usual “skip your morning latte” advice, offering practical, albeit sometimes unconventional, strategies to retain more of your hard-earned money without drastically altering your quality of life. Let’s dive into these small changes that promise significant savings.

1. Embrace Store Rewards Programs

Signing up for those rewards programs at stores you frequent is a no-brainer way to save money. These programs often offer exclusive discounts, points on purchases that convert into savings, and special coupons tailored to your shopping habits.

The savings might seem trivial on a single grocery run, but over months and years, they can accumulate substantially. Don’t miss these opportunities simply because the savings seem small upfront.

2. Use Less Laundry Detergent

The instructions on laundry detergent are often more generous than necessary. Cutting to half a capful or using one pod instead of three can leave your clothes clean and fresh. This extends the life of your detergent supply, saving money over time, and it’s also better for your washing machine and the environment.

Overusing detergent can leave residues on your clothes and inside the machine, leading to unnecessary wear and tear.

3. Automate Savings From Your Paycheck

Setting aside a portion of your pay into a separate savings account is a painless way to build your nest egg. Ensure this account has no card attached, making impromptu withdrawals less tempting. Over time, this habit can help you amass significant savings, acting as a financial buffer for emergencies or enabling you to fund larger goals without debt.

4. Negotiate Your Salary and Consider Job Switching

In today’s dynamic job market, staying complacent about your income is a missed opportunity for financial growth. Regularly renegotiating your salary and being open to switching jobs for better pay are proactive strategies to increase your earnings.

This approach boosts your immediate income and can significantly impact your long-term financial trajectory through higher savings and investment potentials.

5. Meal Prep for Lunch

Preparing your meals in advance, especially for lunch, can drastically cut your food expenses. Eating out or ordering delivery is significantly more expensive than home-cooked meals. Meal prepping allows for bulk buying, which is cheaper, and reduces food waste by ensuring all ingredients are used. Plus, it’s healthier, giving you control over what you eat.

6. Cut the Cords

Eliminating cable TV and landlines can lead to substantial monthly savings. Traditional cable and landline services often represent an unnecessary expense in the era of streaming services and mobile phones. Opt for streaming services tailored to your watching habits, and consider a mobile phone plan that meets your needs without the fluff.

7. Churn for Bonuses

When done responsibly, credit card and bank account churning can offer a stream of cash bonuses, rewards points, and other perks. This strategy involves signing up for new financial products to earn sign-up bonuses and moving on once the reward is secured. However, it requires meticulous management to avoid fees and negative impacts on your credit score.

8. Maximize Cash Back Rewards

Using cashback credit cards for everyday purchases and shopping through cashback websites can earn back a percentage of your spending. These small percentages add up over time, translating into significant savings. Always pay off the balance in full to avoid interest charges, which can negate cashback benefits.

9. Invest in High-Yield Savings and Bonds

Placing your savings in high-yield accounts, CDs, T-Bills, and Bonds can earn you higher interest than traditional savings accounts. This strategy requires some research to find the best rates and terms but can significantly enhance the growth of your savings over time.

10. Drink More Water

Choosing water over soda, juice, or other beverages can save you money when grocery shopping and when dining out. Water is healthier and less expensive, especially if you invest in a reusable water bottle to avoid the cost of bottled water.

11. Embrace DIY Repairs

Learning to do your repairs around the house can save you a fortune in service calls and labor costs. There are tutorials online for almost any minor repair or home improvement project. This not only saves money but also equips you with valuable skills.

12. Stop Drinking Alcohol

Cutting out alcohol can lead to substantial savings. The markup on alcoholic beverages at bars and restaurants is significant; even purchasing from stores adds up. Additionally, reducing alcohol consumption can have positive health benefits, potentially lowering medical expenses.

13. Give up Tobacco

Similar to alcohol, tobacco products are heavily taxed and expensive. Quitting can save a smoker thousands of dollars annually, not to mention long-term health care savings from reducing the risk of smoking-related diseases.

14. Switch to Dryer Balls

Using dryer balls instead of dryer sheets can reduce drying time and eliminate the need to buy disposable sheets. Dryer balls can be used for years, offering long-term savings and a more eco-friendly laundry option.

15. Ditch Paper Towels for Reusable Cloths

Substituting paper towels with reusable cloths can reduce waste and save money. Washable cloths perform the same tasks as paper towels and can be reused for years, reducing the need for constant repurchases.

16. Measure Soap and Body Wash

Using only the necessary amount of liquid soap, body wash, and other toiletries can extend the life of these products. Many overuse these products without added benefits, so being mindful can lead to savings over time.

17. Make Your Stock

Saving vegetable scraps, meat, or bone leftovers to make homemade stock is an economical and flavorful alternative to store-bought options. This practice saves money, reduces food waste, and enhances your cooking.

18. Prepay Bills With Tax Refunds

Using your tax refund to prepay bills, such as a year’s worth of cell phone service or utilities, can offer peace of mind and potentially unlock discounts for prepayment. This strategy ensures that essential services are covered and can free up monthly cash flow for other expenses or savings.

19. Rethink Your Gym Membership

Purchasing home exercise equipment, like a stationary bike or walking pad, can be more cost-effective than a gym membership in the long run. This one-time purchase eliminates monthly fees and can be more convenient, encouraging consistent use.

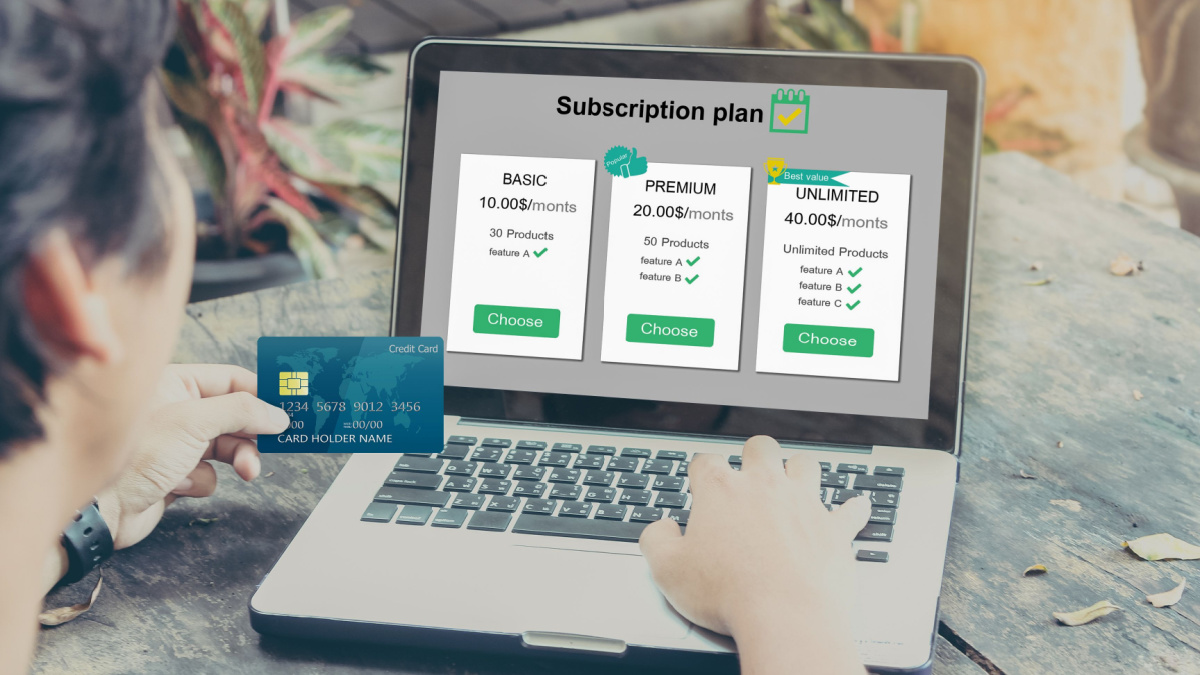

20. Review and Reduce Recurring Bills

Regularly auditing recurring expenses, such as subscriptions and utility bills, can uncover unnecessary services or opportunities to switch to cheaper providers. This habit can lead to significant monthly savings by eliminating waste and optimizing spending.

15 Items That Used to Be Cheap but That Are Now Shockingly Expensive

It’s no secret that the cost of living continues to rise. While some items have remained affordable, others have seen significant price hikes that might shock you.

From everyday essentials to guilty pleasures, here are 15 items that have become shockingly expensive.

15 Items That Used to Be Cheap but That Are Now Shockingly Expensive

I’m Frugal: Here Are My Top 30 Frugal Living Tips to Save Money

I’m super frugal, and one of my passions is sharing my frugal living tips with everyone.

Here are some of my absolute favorite frugal tips to help you get started on your journey to frugal living.

I’m Frugal: Here Are My Top 30 Frugal Living Tips to Save Money

15 Things That Are No Longer Worth It Because of How Expensive They Have Become

Everything comes with a hefty price tag these days. From indulgences to essentials, the cost of living keeps rising. We used to consider certain items affordable options, but now they’ve become so expensive that they’re no longer worth it. Here are 15 things that have lost their affordability and make us wonder if they are worth it!

15 Things That Are No Longer Worth It Because of How Expensive They Have Become

28 Practical Ways Frugal People Save Lots of Money

Saving money doesn’t have to mean saying goodbye to life’s little indulgences. With a few smart tweaks, you can stash away cash for that dream vacation, rainy day fund, or splurge-worthy purchase without feeling like you’re on a constant budget patrol.

Think of it as a side hustle that pays off without the extra hours. Whether you’re looking to conquer debt or simply boost your bank account, these tips are guaranteed to put more money in your pocket, painlessly.

28 Practical Ways Frugal People Save Lots of Money

14 Ridiculously Random Tips That Could Save You Lots Of Money

Want to save some money? There are so many ways to save money that are published in articles all day, every day.

It can be tiring to sort through them and find the ones that work for you, so we decided to scour the internet and find some of the best ones to share with you. But we couldn’t decide which ones to share with you, so we just decided to share the ones we liked, which means that these are pretty random!

14 Ridiculously Random Tips That Could Save You Lots Money